The Bo Horvat Trade: What it Means For the Long-Term Success of the Canucks and Islanders

A tale of two directions

Thanks for subscribing to Hockey Curious.

Today we’ll be breaking down the long-term organizational effects of the Bo Horvat trade on the New York Islanders and Vancouver Canucks.

Vancouver Canucks

The Canucks have been in the bottom third of the NHL in win percentage over the past 5 seasons while also having the 19th-ranked asset pipeline in terms of quantity and 22nd-ranked in terms of quality. With little trade capital and multiple distressed assets, paired with the team’s on-ice performance, the Horvat trade had to be one that created liquidity for the Canucks.

Whether you’re rebuilding or retooling, this is the type of move you make. Why? Rebuilding teams want to liquidate assets in return for draft picks and prospects in order to replenish their asset pipeline. Retooling teams want cap flexibility and liquid assets so that they have trade capital and can alter their asset allocation mix.

Related readings:

Regardless of the label you put on what the Canucks are doing - the term Rutherford and Allvin have been steadfast in using is “building” - the Canucks liquidated Bo Horvat into two future assets.

Instead of committing more money to Horvat and adding to their illiquid assets, they got future assets in Aatu Raty and a 2023 conditional first-round pick.

Raty enters the asset pipeline as a top-two prospect for the Canucks which says more about the dearth of quality prospects in Vancouver’s system than Raty’s potential. In Raty there is value to be mined from leveraging the development program that Vancouver has heavily invested in since their regime change. Can this new management group turn its asset pipeline into a steward for organizational success?

The 2023 first is, in my eyes, the centerpiece of this deal. Either it is a mid-late first in a historically deep draft or it is an unprotected 2024. The Islanders were my most sought-after first for this reason: they seem to be fighting reality, trying to push for a playoff berth, and could be one injury to Ilya Sorokin away from being a bottom team next year. Buying a short position on a bubble team like the Islanders is about as good of a first-round pick as you can fetch in-season.

If we are to take Jim Rutherford’s comments at face value and follow his timeline that this “retool” will take under three years, I wouldn’t be surprised if they try to monetize these assets for a player further along the timeline that fits their roster needs.

“Three years and I’d like to think it’s quicker than that because we have a lot of good players here, but do we have a team to win at all costs?” - Jim Rutherford on his hope for a turnaround

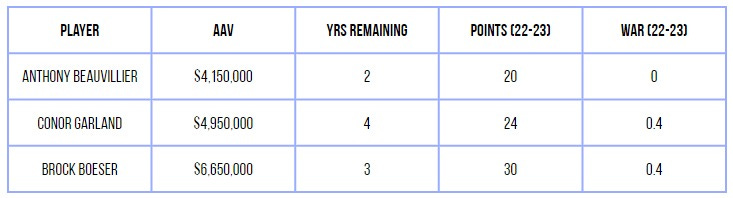

Now let’s tackle the Anthony Beauvillier side of the equation. It sounds like the Canucks brass like the player and wants to use him in the team’s top six. However, I can’t help but wonder why Beauvillier isn’t just as distressed and illiquid an asset as other Canucks middling wingers like Conor Garland and Brock Boeser, and therefore more value could have been had as compensation for taking it on.

Is this an early signal of money being even harder to move in the flat cap era or does it show that the Canucks believe that they bought low on a long-term piece? Yes, Beauvillier is only signed through the 2023-24 season but that cap could have been used to take back something that could have fetched more futures like Josh Bailey who expires the same year as Beauvillier and costs just $1 million more (the amount they retained on Bo Horvat). The hope is that the Canucks can resuscitate Beauvillier to his 2020-21 form and either he becomes a piece of the future or they can recycle him for even more assets next year.

New York Islanders

The Islanders are almost in the identical position as the Canucks. They have also run at a draft pick deficit in four of the last five seasons resulting in the 23rd-ranked asset pipeline for quality and quantity. They have seen more success than the Canucks on the ice with the 16th-best points percentage. However, in the last three seasons, the Islanders have had the 17th-best points percentage in the NHL while the Canucks were not far behind at 19th.

But the Islanders opted to go in the opposite direction of the Canucks, using some of the last remaining trade capital in their war chest to acquire Horvat and try to push for a playoff spot.

Further to the Islanders’ risk, either Horvat walks in free agency and they spent their trade capital for nothing. Or he re-signs, instantly making him a highly illiquid asset. If the new-look Islanders team with Horvat is still not good enough to contend, it will be even harder for the Islanders to reallocate dollars in their asset mix if Horvat signs long-term.

New York got the best player in the package, which should come as no hot take. He’s developed into one of the best finishers around the crease in the league. While his 50-goal pace may not last past this season, he is a legitimate 30-35 goal scorer, can be relied upon in a matchup role, an elite finisher in the bumper spot on the powerplay (an area NYI desperately needs help in), is a faceoff ace, and elevates his game when the shifts matter the most.

What this trade says about Lou Lamoriello and the Islanders is that they believe they have the right asset allocation mix to win right now and needed to add Horvat to get them across the finish line. They better hope they are right.