Welcome to Hockey Curious.

Today we’ll be examing the conditions that created the Brandon Hagel trade to see if they can be reproduced to unlock a value stream for other teams.

Previously in the newsletter, I discussed why the Blackhawks did so well to monetize a highly liquid asset in Brandon Hagel.

I came away with these three lessons:

They added additional value by signing Hagel to a highly liquid contract which took strong faith in not only the player but also the coaching and development staff.

The Blackhawks exemplified the asset pipeline’s flywheel effect by developing one prospect they acquired for free into an asset that returned four future pieces.

Most importantly, GM Kyle Davidson was disciplined. He stayed on course in his long-term plan and didn’t let the emotions of losing a young and valuable player impair his decision-making.

Lesson 1 is what I want to dive deeper into. While Brandon Hagel the player is a nice component in any team’s top-six, what drove up his value was the three-year contract he signed for a $1.5 million annual-average value.

This contract made him extremely attractive to potential buyers because he was cost-controlled over three seasons with a cap hit that was easy to fit onto a contender’s roster. In other words, he was a highly liquid asset.

Related readings:

In his second season in the NHL, Hagel’s production spiked which made his three-year contract look like a bargain. His usage increased as he rode alongside Patrick Kane. His shooting percentage received a massive bump and his rate scoring bloomed. It couldn’t have happened at a better time for the Blackhawks.

So two questions arise:

Are there any potential candidates that follow the Brandon Hagel blueprint at this year’s trade deadline?

Is there a repeatable method to create the next high-liquid contract trade?

The Next Brandon Hagel

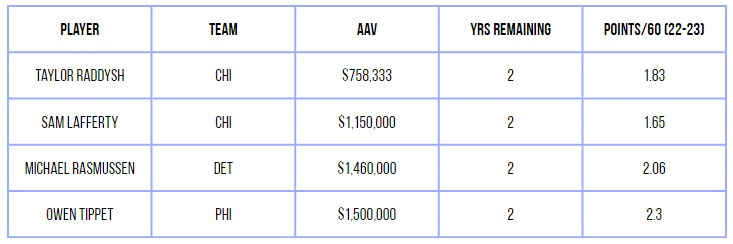

I went to CapFriendly.com and searched for players under 27 on standard player contracts (to exclude entry-level contracts) and filtered for players making under $1,500,000 with a contract expiring in 2024 or later.

I then removed players on playoff teams or 5 points within a playoff spot as these teams would want to keep highly liquid assets to assist in their post-season endeavours. What follows is a list of the highest scorers remaining.

Note: Just going off of points is not a wholistic way to do an analysis of the talents of a player but it’s a quick and easy proxy to use for the sake of this article.

Funnily enough, the next team with the assets to make a “Brandon Hagel-like trade is the very same team that pioneered it. The Chicago Blackhawks have Taylor Raddysh and Sam Lafferty who could be candidates.

Taylor Raddysh is playing in Chicago’s top six and scoring at a 1.83 points/60 rate. His minutes have skyrocketed along with his shooting percentage.

Sam Lafferty is older at 27 and scoring at a slower rate on Chicago’s third line but he is another option for contenders and is too old for Chicago’s timeline.

Michael Rasmussen is having a breakout performance more than doubling his assists/60 rate giving him a 2.06 points/60. Detroit’s window of contention should align with Rasmussen’s peak production years so he is likely a piece Steve Yzerman will want to keep unless the trade package is just too good to turn down.

I wonder if Yzerman extends him in the summer to try and keep his AAV down. Again that comes down to faith in the player and the coaching staff to keep him on track.

Owen Tippet is the most interesting asset on the list mostly because of the team he is on. For any other team, it would seem like a no-brainer to keep him as a 23-year-old. A team transitioning from rebuilding to playoff contender would love him, and so too would a true Stanley Cup contender. However, the Philadelphia Flyers are neither. They are stuck in the middle with limited cap flexibility and a shallow asset pipeline.

I wonder if they pick an asset harvesting direction and decide that at 23, it’s time to cash out on Tippet. Or do they view him as a piece that fits into the future? It all depends on how long they think it will take for them to turn it around.

Unlocking a Value Stream

It all starts with implementing sound infrastructure in the asset pipeline. Without a solid development team, it is irresponsible to take a risk on a player that only has 1 year in the NHL to commit millions of dollars over 2+ seasons (Clear cut star players aside). If you feel confident in the development team, then taking a chance on players you believe in long-term for what could be a value cap hit is the first step in creating the conditions for a Brandon Hagel-like trade.

The next step would be to put him in an environment to succeed. That means having a role for them in the top six alongside a player that can make him better. That usually means a star player like Patrick Kane. This is where an analytics team joins forces with the coaching and development staff to find the ideal conditions for this player.

I’m reminded of Mike Gillis’ front office in Vancouver that took Ryan Kesler from a 20-goal scorer to a 40-goal scorer. They identified conditions where Kesler succeeded and where he was ineffective.

“We determined we didn’t want him carrying the puck through the neutral zone because nothing happened, we didn’t want him carrying the puck over their blue line because nothing happened, but if we retrieved the puck within about a 10-metre radius of the net, good things happened all the time with him on the ice.” - Mike Gillis on using analytics to aid Ryan Kesler

Put the player in a situation to succeed along with betting on his upside with a mid-term contract and a front office may have created a value stream to extract assets for their pipeline in a rebuild.